Gold Prices Moving Higher as Interest Rates Increase

Go back to early 2013. At that time, we were told that gold wasn’t worth holding because the Federal Reserve would be raising its benchmark interest rates and stopping its printing machines. This phenomenon sent gold prices tumbling.

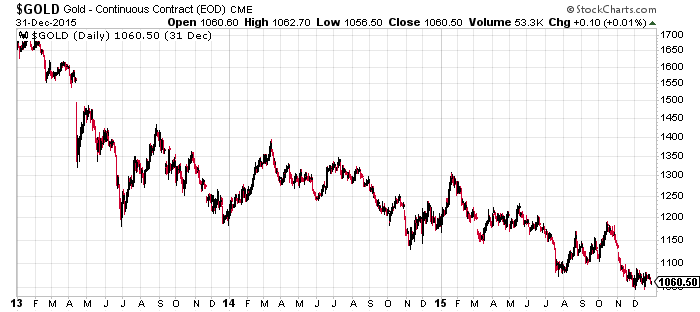

Gold prices went from trading around $1,700 in early 2013 to a low of around $1,050 in late 2015.

For precious metal investors, it was just a bad time. No matter where you looked, losses were mounting. Gold-backed exchange-traded funds (ETFs) witnessed outflows, and mining shares’ value were slashed in half, if not more. Remember that this was all based on the theory that gold prices decline when interest rates go up.

Look below at the chart. It shows how gold prices reacted between 2013 and 2015:

Chart courtesy of StockCharts.com

Fast forward to the end of 2015. This is when the Federal Reserve actually started to raise rates and had completely stopped printing money. Since then, the Federal Funds rate has soared from 0.25% to 1.5%.

The yield on bonds has started move higher too. If we follow the “higher interest rates are bad for gold” theory, gold prices should have tumbled much more when the Fed began raising rates and shut down printing presses.

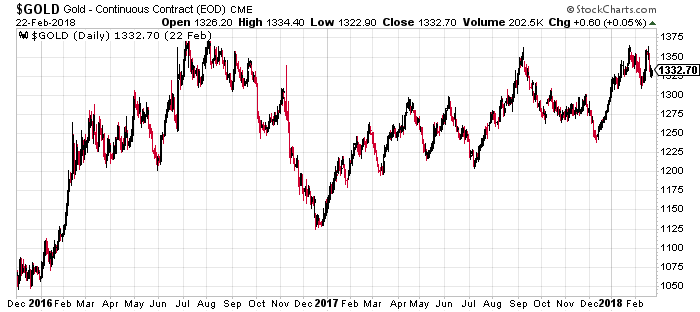

Instead, we saw the complete opposite. Look at the gold prices chart from late 2015 to now:

Chart courtesy of StockCharts.com

Gold actually performed well. It’s up roughly 30% since its lows in 2015.

What’s also interesting to note is that gold prices are trending higher. With this, remember the most basic rule of technical analysis: the trend is your friend until it’s broken. So gold prices could go much higher.

Why Stay Bullish on Gold Prices?

Dear reader, for me, gold prices remaining resilient as the Federal Reserve is raising rates is enough reason to be bullish.

At its core, this tells me that there are buyers in the market and that sellers have diminished. This could be great in the coming months and quarters.

Mind you, the fundamentals of the gold market remain very strong as well. We see massive demand coming out of India and China. The demand for the precious metal is coming from uncanny places like Europe as well. Central banks continue to buy precious metal for their reserves too.

As demand is strong, the supply side is crushed, to say the least.

Mining companies cut back on exploration as gold prices were dropping. They are just starting to spend money on exploration again, and it could take several years for production get back to normal.

What’s Ahead?

It can’t be stressed enough: the case for owning gold continues to get stronger by the day. The mainstream will have you convinced that it’s not worth the investment or that things like Bitcoin might sway investors away from it.

Gold is currently trading at rock bottom prices. You must also consider that it’s one of the only assets that hasn’t increased in value and is not “bubble-like.”

It wouldn’t be shocking to see 2018 be another year when gold prices move higher and resume the uptrend that began in 2015.

One key level to look out for is $1,375. If the precious metal’s price is able to break above this level, we could see much higher gold prices.